With an estimated 15.5 million trucks operating daily on roads in the United States, it’s important to keep your drivers safe (TruckingInfo.net). Training drivers to be safe and careful while delivering loads is key to growing your trucking business, as it can impact your company’s finances, fuel costs, and truck maintenance expenses.

Here are just a few of the trucking safety challenges for commercial drivers. Even if they seem routine or predictable, it’s important to make sure your drivers remember them.

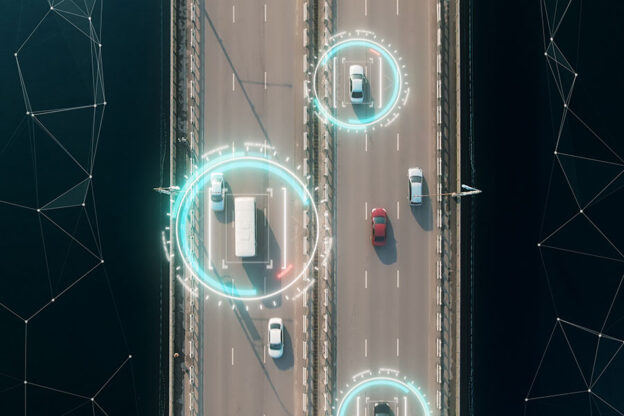

Large Blind Spots

Limited visibility calls for extra caution in passing and being passed by other large vehicles on the road. Large trucks also need to maintain a longer following distance so they can see all of the vehicles behind them. Cars are often ignorant of the blind spots that trucks have, so it’s up to truck drivers to be vigilant about spotting where cars are moving. Extra side mirrors can be helpful in improving visibility.

Long Stopping Distance

Trucks traveling 65 miles per hour take up to two football fields to stop, so it’s important to have a ‘buffer zone’ in front to protect your drivers and your trucks. The more following distance in front of the truck, the more time drivers have to correct or slow down if other drivers cut in or stop suddenly.

Limited Maneuverability

The turning radius for a truck is 55 feet, so check for smaller vehicles that try to get by when you’re turning. Be aware of the impact a truck makes when accelerating, stopping, and maneuvering between lanes or making a turn. Slowing down significantly for curves and ramps is also a key point to remember – especially with a truck’s higher center of gravity.

Incentivize Safe Driving

To help ensure safe driving, many trucking companies offer small bonuses for driving without any speeding tickets or other citations for a certain period of time. By monitoring driving records – something you’re most certainly doing already – you can identify which drivers have earned bonuses or other rewards for their compliance.

The Financial Benefits of Safe Drivers

Training your drivers for better safety provides benefits not only for drivers, but for your trucking company’s finances.

- Reduced incident rates decrease crash-related liability costs

- Leveraging safety ratings to retain and hire more drivers

- Better productivity by keeping drivers on the road

- Lower insurance costs

Safe driving is good for your reputation, your finances, your drivers and their families. Additional FMCSA tips for CMV drivers can be found at: https://www.fmcsa.dot.gov/ourroads/tips-cmv-drivers.